Overview

Modernizing legacy banking systems is a challenge facing almost every segment of the banking industry.

Stable legacy systems do what they were created for, but were never designed for the types of digital and data demands found within today’s market.

However, moving from legacy systems to a modern cloud platform is a challenging process with significant costs and risks involved. Any attempt to transition thoughtfully will involve mitigating as much risk as possible.

In this article, we will lay out a strategy to accelerate the process while reducing risk during migration.

Why are legacy banking systems so entrenched?

A legacy system refers to outdated hardware and/or software systems still in use because they are still able to fulfill their intended purpose, but cannot be updated with modern technology advancements nor be easily upgraded or integrated with newer systems.

In the case of banks, if you peek underneath mobile apps, websites, and high-end features of those applications, the actual transactional records of deposits and loans are often being handled by systems running COBOL—similarly to systems in the 1970s—then followed by decades of arcane patchwork fixes over the years.

What’s being lost by not modernizing?

These systems still work. They are often resilient and reliable in narrow contexts. So why modernize at all?

- Difficult to integrate: If modern and cloud-native systems and software packages need to be integrated into the business, they all need to connect back to the legacy systems, which were not designed for easy interoperability.

- Diverse vendors: Legacy systems in banking are only supplied by a handful of vendors, meaning that those vendors can often set prices.

- Lack of legacy talent: Developers for the older platforms are often nearing retirement age and aren’t being replaced by new talent entering the market. A limited pool of resources makes it difficult to keep up with business demand for legacy hardware and software.

- Limited ecosystem: There are a significantly greater number of limited application ecosystems for legacy banking systems, so new vendor packages are not readily available, restricting business agility.

- Growing volumes of interactions: Modern, fully digitized, and ecosystem-interconnected banks handle a higher volume of real-time interactions. Not all legacy systems can easily scale to this volume of interactions, leading to unsatisfied customers.

This amounts to a system that costs a lot of money to expand and upgrade.

Why keep legacy systems at all?

Legacy systems have reliably worked for years and replacing them can incur significant upfront costs, even if there are expected savings long-term. Most banking organizations know that they need to modernize their systems but get caught in the challenge of doing so in an effective and cost-efficient way.

How to mitigate risk when modernizing legacy banking systems

When banking organizations modernize their systems in one massive move, the risks and costs can balloon. Programs sprawl over years, and the return on investment (ROI) seems further and further away. In some cases, attempts to tackle everything all at once results in costly backpedaling to old systems if the update plan was not fully thought out or tested.

This is why a strangler pattern approach is a key strategy in modernizing banking systems and moving toward modern connected banking.

What is the strangler pattern?

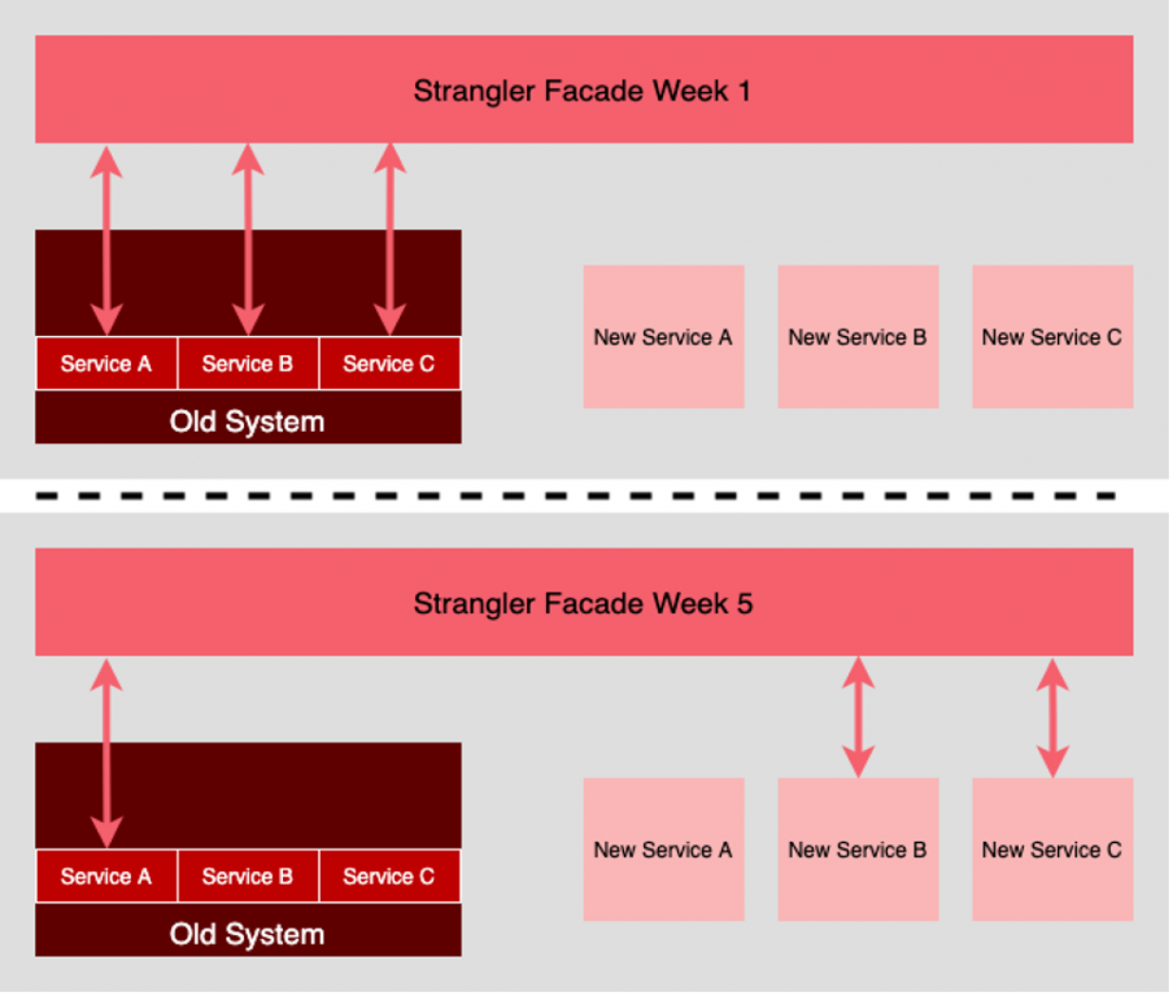

The strangler pattern, or strangler fig pattern, is the process in which a legacy system is put behind an intermediary facade.

Then, over time, replacement services for the old system are added on the other side of the facade. In most cases, all of the functionality of the old system is replaced by modern systems and as a result the facade can be removed. If desired, a few elements of the legacy system can remain.

The advantage of the strangler pattern is that new modern systems can be implemented into the business in small chunks, meaning not only does the overall process start sooner, but the advantages of the modern systems can begin providing a return on investment (ROI).

One of the largest points of resistance to modernizing legacy systems in banking is the complexity and costs involved in the transition. Breaking that complexity up into smaller pieces reduces the overall risk of the transition and allows time for banks to reskill staff on the new systems.

However, for the strangler pattern to work most effectively, the technologies being adopted need to be cloud-native and designed for hybrid cloud environments.

How a cloud platform supports modernizing legacy banking systems

Microservices and containers supported by a modern cloud platform can help when modernizing legacy systems in a few key ways:

- Incremental replacement: Containers allow you to gradually replace functionality in the legacy system with new components by providing an isolated environment for the new components to run. This makes it easier to incrementally replace parts of the legacy system without affecting the rest of the system.

- Interoperability: Legacy systems often rely on outdated technology that makes it costly and time consuming to integrate with other systems. Cloud platforms provide access to modern frameworks and runtimes that reduce the cost of connecting services together.

- Improved testing: Containers allow for the simpler creation of testing environments that closely mirror production environments. This can improve the quality of testing and reduce the risk of issues arising during deployment.

- Deployment flexibility: Containers can be deployed on a variety of infrastructures, including on-premise and off-premise data centers. This flexibility allows for greater agility in deployment and can make it easier to meet changing business needs.

- Scalability: Legacy systems may struggle to handle increasing loads or demand. Cloud platforms provide a scalable environment that can handle fluctuations in demand, making it easier to ensure that the system is always available and responsive.

So, to modernize rapidly, an organization needs to do so incrementally and with a cloud platform that accelerates development and ultimately drives down the cost of operations.

How can Red Hat help you modernize your legacy banking systems?

Red Hat offers a modern cloud platform that allows you to break your legacy banking systems into smaller components so that you can reduce the cost and complexity of progressively modernizing them.

Red Hat provides cloud technology that speeds up the development of microservices and provides the tools to secure and operate them efficiently across any infrastructure, including on the mainframe. So, if your modernization efforts require you to keep workloads on-premise, Red Hat allows you to modernize within that context and gives you the runway to move those workloads as needed in the future.

If you do not know where to start with your modernization efforts, Red Hat® Consulting can walk you through options and help create a roadmap that works for you.

Red Hat helps solve banking modernization challenges

Modernizing with Red Hat helps solve several key challenges, including:

- Simplifying an organization's technology estate for a more consistent operational experience.

- Tools to assist moving from legacy systems to cloud technology.

- A cohesive approach to accelerate microservice development and delivery.

- Assisting organizations in fully integrated security measures across their technology estate.

- Offering extensive training paths to prepare teams to work more effectively in modern environments.

Key Red Hat solutions that help banks modernize legacy banking systems:

- Red Hat® Enterprise Linux® and Red Hat® OpenShift® provide the foundation to run and operate across any infrastructure.

- Red Hat® Application Foundations allows you to accelerate the delivery of cloud-native applications.

- Red Hat Consulting, Training and Certification bridge the skill gap in-house developers may have through partnerships and training paths.

- Key ecosystem partnerships to help create important working connections between legacy and modern systems.

How are others approaching modernizing their systems?

We asked technology decision makers about their modernization priorities, challenges, and plans, and how they define success.

What core banking partners do you work with?

We work with a range of partners including Thought Machine, Temenos Infosys Finacle, Finastra and others that offer cloud-ready core banking services with Red Hat.